We’re in the season of financial quarterlies. That period of time when publishers perform their legal obligations to shareholders, and game sites pretend that they employ financial journalists to publish thrilling stories like “Gosh, Activision say they made a lot of money.”

Quarterly (and annual) financial reports can sometimes reveal things of interest to a broad audience of games players. EA’s recent filing suggested that the Mirror’s Edge not-quite-sorta-sequel will probably be released in early 2016. Unless it isn’t, due to the fluctuating nature of games development and its common tendency for delays. Solid news!

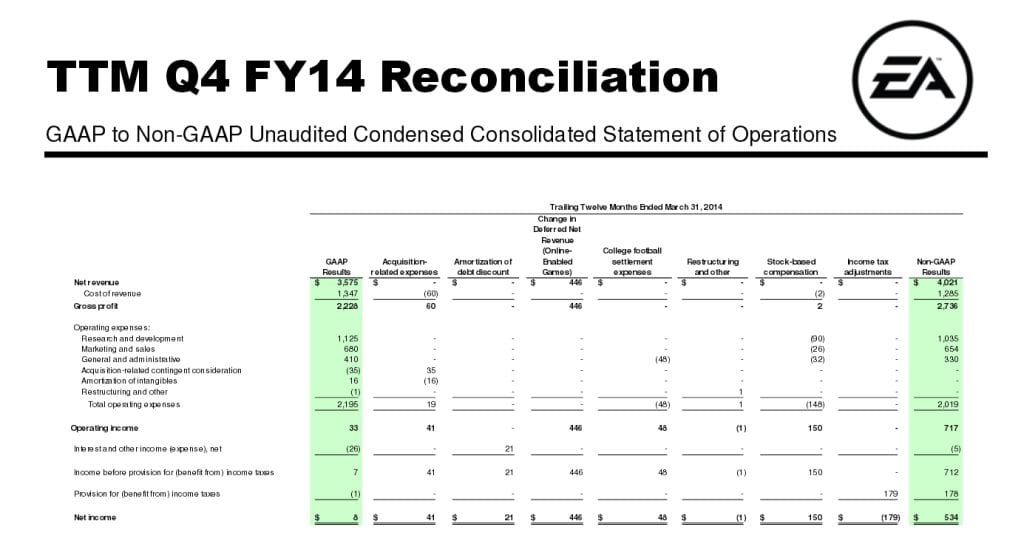

But those instances are rare, and what really packs the pages of these financial reports are scores of baffling graphs and charts.

There’s nothing videogame fans love more than unaudited statements of operations.

The entertaining thing about the graphs and statements pertaining to things in the future is that they could all be utter bobbins. Look at the beginning of any of this week’s financial statements, and you’ll find sentences like this one, from Activision’s: “Forward-looking statements are subject to business and economic risk, reflect management’s current expectations, estimates and projections about our business, and are inherently uncertain and difficult to predict. Our actual results could differ materially.”

Any statements about future game sales or commitments? Might be total rubbish. As long as the publisher’s statements are “believed to be true when made” (to quote Activision’s document again,) they can put whatever they like in there.

EA won’t commit to the estimated figures in its 5 May report beyond the day itself (“These forward-looking statements are valid as of May 5, 2015 only”) and is even a bit iffy on whether it’ll report the same data to the Securities and Exchange Commission: “While Electronic Arts believes these estimates are meaningful, they could differ from the actual amounts that Electronic Arts ultimately reports in its Annual Report on Form 10-K for the fiscal year ended March 31, 2015.”

“Cayman Islands” eh? I wonder why the 2013 Vivendi deal went through THAT particular notorious tax haven.

Quarterly financials are not a generous peek at the fiscal structures of large corporations, they’re a legal obligation to shareholders. As a result, they’re half optimistic puffery and half obfuscated financial legalise.

If you need convincing further, here’s a page with a link to THQ’s annual report for 2012. The document admits the company has had a “difficult year,” but is very confident that “We are well positioned to deliver our highly-anticipated pipeline of games to market in fiscal 2013 and beyond.” A great many graphs and charts follow, empirically proving just how well positioned.

Three months later THQ were bankrupt, and their intellectual properties were being lined up for auction.

But hey, I’m sure all the claims in that report were believed to be true when made.

Maybe a trained financial sorcerer could’ve divined some clues to this impending disaster from lines like “Beginning September 30, 2012, the EBITDA requirements are replaced with a requirement that we maintain an annual fixed charge coverage ratio of 1.1 to 1.0.” or “Costs incurred to obtain our long-term debt are recorded as deferred financing costs within “Other assets — non-current” in our condensed consolidated balance sheets and are amortized over the terms of the respective debt agreements using a straight-line basis for costs related to the Revolver,” but the average reader (or games writer) didn’t stand much of a chance.

Especially as the whole purpose of the document is to make things look as cheery as possible.

Everything will be fine. You can trust my smiling face.

What’s especially aggravating about the hand-picked statistics and financial ‘highlights’ is that they sort of pretend to divulge basic sales information (something potentially useful and interesting!) but never quite manage it.

Snippets like “11 million beta sign-ups for Heroes of the Storm” make for a easy, publisher-approved headlines, but don’t actually tell us all that much. How many of those people are actively playing? How many paid for the $40 USD “Founders” pack which gave them access to it ahead of others? That sort of thing.

EA’s efforts for Q1 2015 were even worse, neglecting any sort of specific sales data for pretty, but also pretty useless, infographics.

3.4 million dragons have been slain in Dragon Age: Inquisition. Great. That probably means it did quite well. But how about laying out some per-platform sales figures with direct comparisons against Dragon Age II and Dragon Age: Origins? You know, something that could be just as easy to parse as the pretty info-pics, but also more relevant, informative and meaningful to those of us interested in contemporary or historical sales figures.

Legally obligated financial transparency isn’t all that useful when it’s able to remain so very … opaque.

Do your stats include information on whether FIFA 16’s servers will work properly?

These gripes are just so many farts in the wind, of course. Quarterly financials aren’t really written for me, you, or the majority of people reading game sites. Our interests are not shareholder interests, and the documents don’t even seem to offer them much in the way of transparent financial information.

They are reports which self-declare their own possible inaccuracies, constructed in a manner that’s both overtly optimistic (for the shareholders) and pretty complex (for any lay-person looking for substantive financial details,) filtered through games writers who tend not to be trained in advanced accounting terminology or procedure.

Aspects worth keeping in mind during “Gosh, Activision say they made a lot of money” story season.

Published: May 7, 2015 06:44 pm