We all had a bad time waiting out the graphics card shortage that took place from late 2020 up until recently, but it wasn’t the first time crypto mining was to blame for a lack of Nvidia and AMD GPUs.

Back in 2017 and 2018 there was another similar situation going on with the GTX 10 Series that led to huge profit increases for Nvidia and higher prices for gamers. Although the sting back then wasn’t nearly as bad as what we just experienced, it does point to a trend at how Nvidia likes to handle sales.

You got the cash, Nvidia has the splash

Simply put, cryptomining and productivity tasks are for business and gaming is just a hobby (for most). Expectedly, companies and profit-geared individuals are far more willing to pay more and to buy in bulk compared to traditional individual retail sales for graphics cards.

Once things started heating up during the last crypto boom, Nvidia was in a great place as a market leader to supply plenty of graphics cards for increased demand. Although the company still doesn’t admit to it, there’s clear evidence that GPU sales surged and subsequently fell based on the volatile nature of the crypto market. This is where the SEC had a problem with Nvidia’s accounting.

Coincidentally, Nvidia witnessed a sharp decline in revenue for the RTX 20 Series when crypto was also down.

As a publicly traded company, Nvidia is required by law to share information with investors so that they can make future investment decisions. For whatever reason, Nvidia chose to be vague at best, and perhaps dishonest at worst with its investors. It attributed its massive revenue gains at the time to gaming and not sales to crypto miners.

Even after investors pressed the issue, enough doubt persisted to get the SEC involved in auditing Nvidia’s sales. This eventually resulted in the SEC bringing charges against the company for intentionally misleading investors. As you can imagine, this led to significant legal negotiations.

Busted, but off the hook

Fast forward to today, and the SEC has finally come to a settlement with Nvidia over the disingenuous reporting of crypto sales as gaming revenue. Nvidia has agreed to pay a fine of $5.5 million USD under the condition of not admitting to any wrongdoing, but with the promise there will be no reoccurring incidents.

To be clear, Nvidia has every right to sell to whomever it so chooses. The matter here is simply a legal issue with respecting investment disclosure laws. However, the SEC was clear that it found evidence of intentional misreporting. Considering that Nvidia made nearly $27 billion USD in 2021 though, this fine of $5.5 million isn’t likely to upset CEO Jensen Huang. It’s also nothing compared to what Nvidia lost in its failed attempt to acquire ARM.

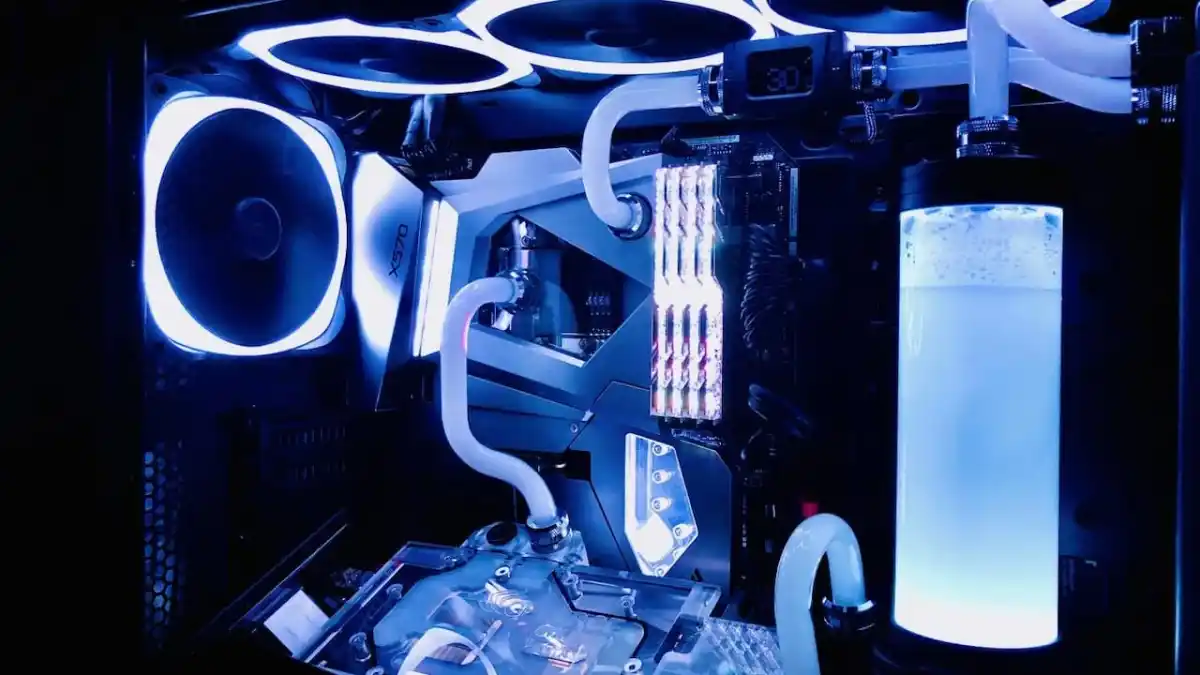

Nvidia’s RTX 3080 is wildly popular and the company continues to benefit from large adoption rates among gamers. (Image credit: Nvidia).

The reality of the situation is that Nvidia remains a clear market leader for GPU design, graphics, PC gaming, AI, and far more. It didn’t win any fanfare among those who were unable to get graphics cards during the 2020-2021 crypto boom though. Unless it remains the clear leader for PC gaming, those who feel burned may begin to look at products from competitors like AMD, and soon, Intel as well.

Published: May 6, 2022 07:15 pm