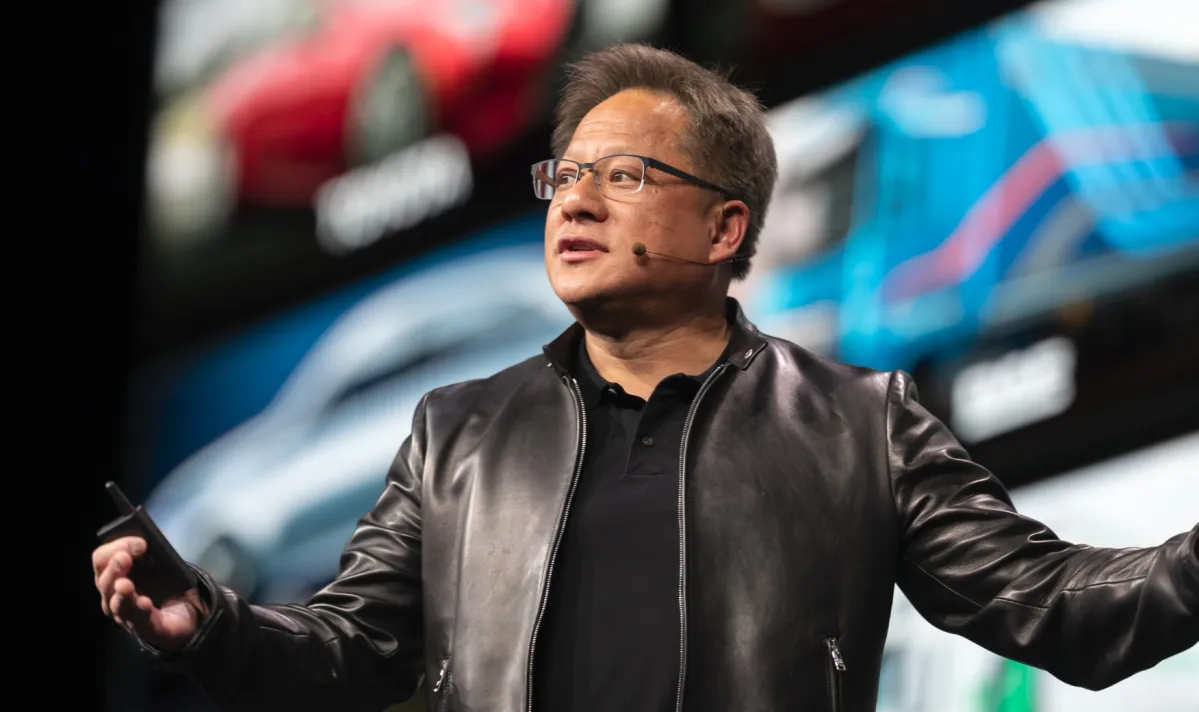

What was shaping up to be one of the biggest acquisitions in tech is now no more. Nvidia’s acquisition of the UK-based chip manufacturer Arm has now been officially terminated. The deal was going to set Nvidia up to be a powerhouse in the industry, potentially putting the company above TSMC in terms of market capitalization.

The main factor in the deal’s cancellation was reportedly due to “significant regulatory challenges preventing the consummation of the transaction.” Arm, and its current owner SBG, now intend to start preparations for setting up the company for a public offering. This is certainly an unceremonious end to a plan that has been in the works for over a year now.

The Nvidia-Arm acquisition is officially dead

While this is obviously bad news for Nvidia, this is perhaps good news for most other parties. There was great concern over the acquisition due to the amount of power that Nvidia would have possessed in the semiconductor industry. After all, it would have then controlled one of the largest chip designers in the world and the associated intellectual property. Things weren’t looking great for the deal even a few weeks ago when reports stated that the companies were planning to abandon efforts to push forward in the regulatory approval process.

The $40 billion USD deal was first announced in September 2020, when Nvidia officially announced its planned acquisition of Arm. Nvidia faced resistance from other industry giants like Apple and Samsung. The deal also faced resistance from the UK government, the US Federal Trade Commission, and China as well. It was clear that the industry wasn’t necessarily happy with Nvidia’s plans for tech domination.

If the deal had gone through, it would have made Nvidia a titan in the industry, giving the company further reach and the option to design new products such as CPUs. The fact of the matter now though, is that the deal is no more and Nvidia’s plans have officially been thwarted. Arm will now be set up for a public offering and more information regarding that is sure to come in the following months.

Published: Feb 8, 2022 11:30 am